Enhanced Yield Strategies

Designed with the objective to provide clients with access to higher yielding products, adding alpha with modest volatility

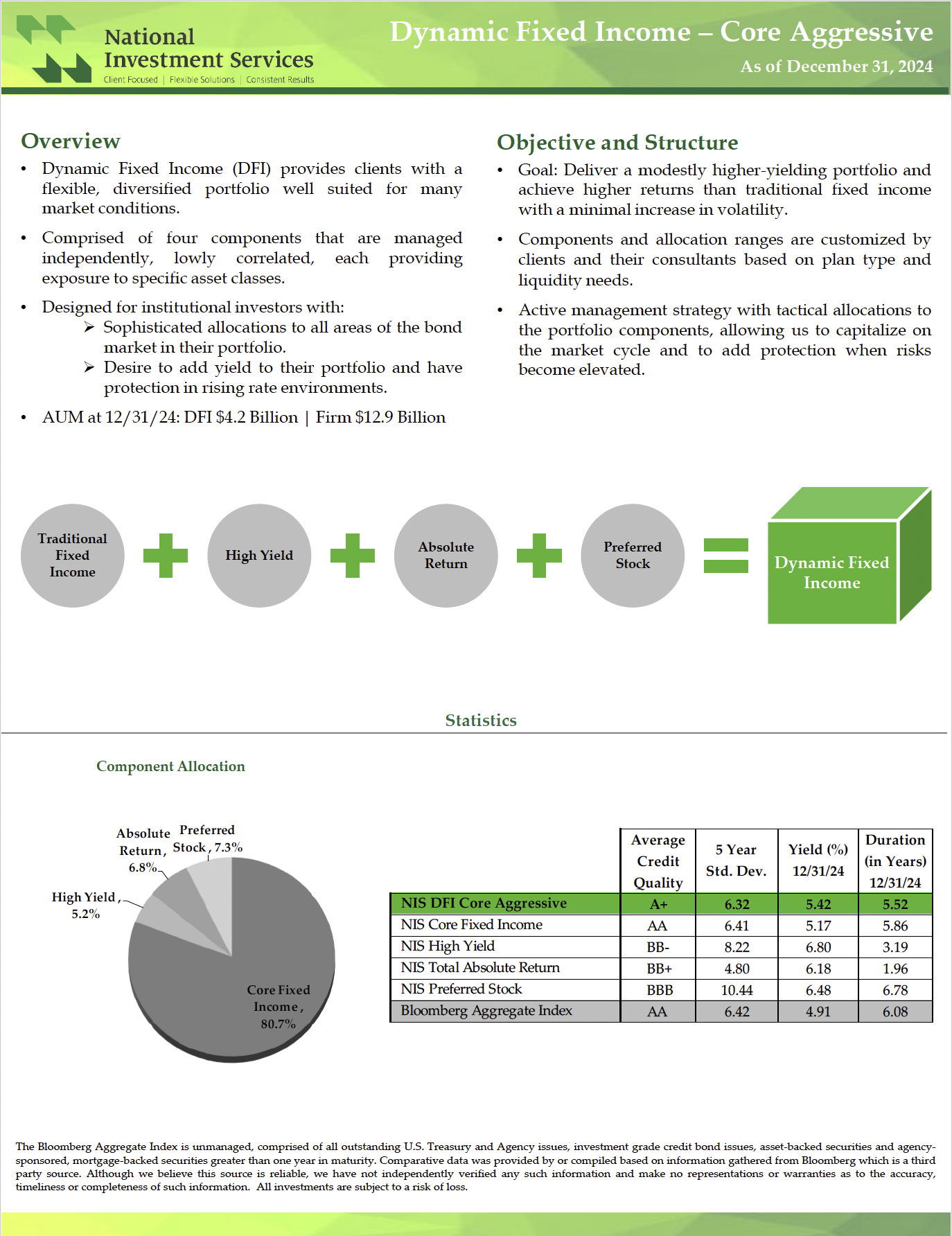

Dynamic Fixed Income

OBJECTIVE

The objective of the NIS dynamic fixed income strategy is to deliver a modestly higher yielding portfolio and achieve higher returns than traditional fixed income with a minimal increase in volatility.

Our dynamic fixed income strategy provides clients with a customizable, diversified portfolio designed with the objective to provide consistent performance and downside protection. It is comprised of four independently managed components with low correlation that provide exposure across asset classes — core fixed income, high yield, absolute return and preferred stock.

STRATEGY AT A GLANCE

- Customized. Components and allocation ranges are customized by clients and their consultants based on plan type and liquidity needs.

- Performance & protection. Using an active management strategy with tactical allocations to the portfolio components, dynamic fixed income allows us to capitalize on the market cycle to improve performance — and add protection when risks become elevated.

- Allocations across fixed income. Dynamic fixed income is designed for institutional investors looking for portfolio allocations in all areas of the bond market, as well as a desire to add yield to their portfolio and have protection in rising rate environments.

OVERVIEW

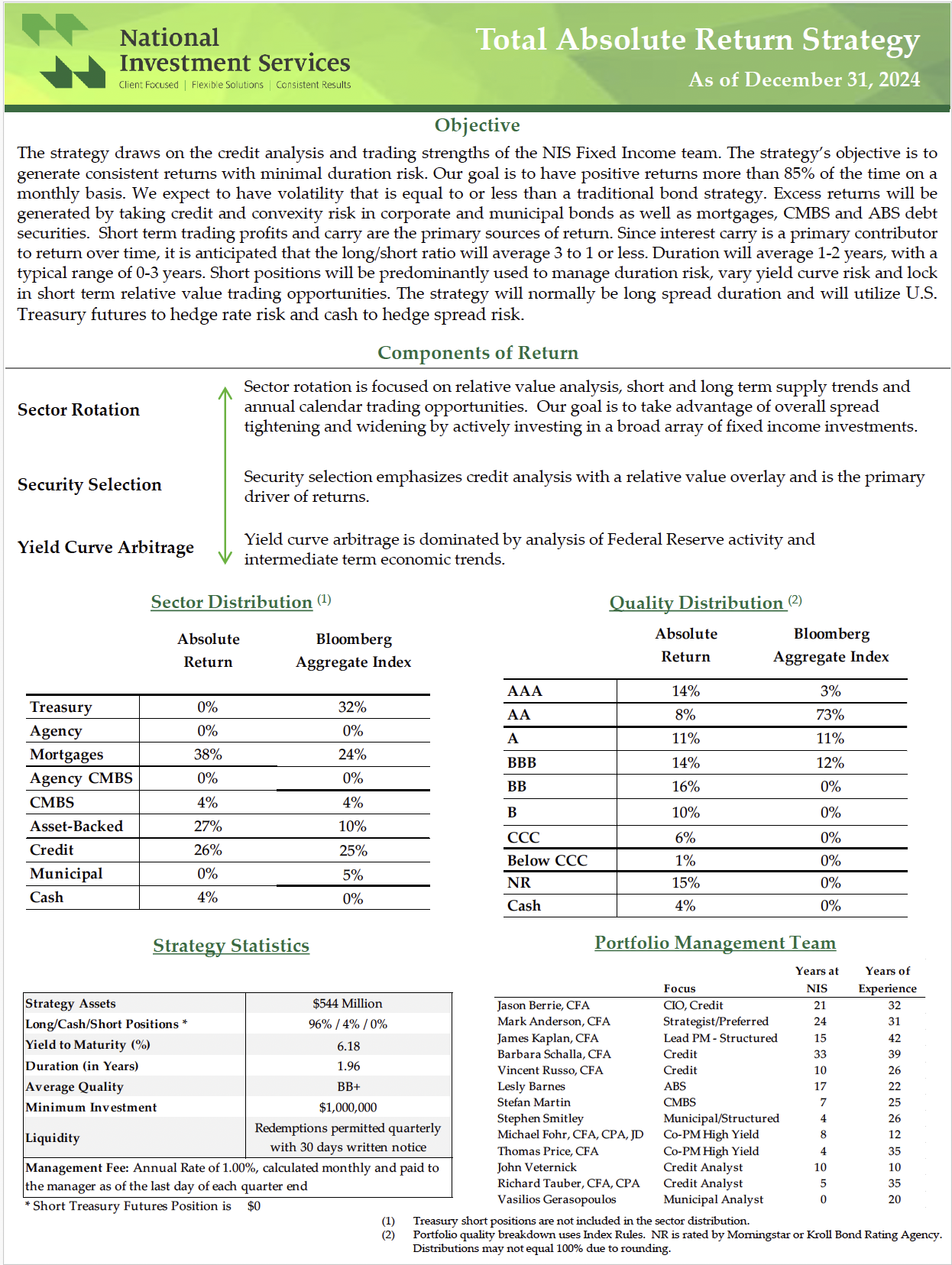

Total Absolute Return

OBJECTIVE

The objective of the NIS Total Absolute Return strategy is to generate consistent returns with minimal duration risk.

Our Total Absolute Return strategy aims to have positive returns more than 85% of the time on a monthly basis. We expect to have volatility that is less than or equal to a traditional bond fund.

STRATEGY AT A GLANCE

- Leverages NIS fixed income team. Our Total Absolute Return strategy draws on the credit analysis and trading strengths of the NIS fixed income team.

- Alpha generation. Excess returns will be generated by taking credit and convexity risk in corporate and municipal bonds as well as mortgages, CMBS and ABS. Short-term trading profits and carry are the primary sources of return. Since interest carry is a primary contributor to return over time, it is anticipated that the long/short ratio will average three to one or less.

- Risk management. Duration will average one to two years, with a typical range of zero to three years. Short treasury positions will be predominantly used to manage duration risk, vary yield curve risk and lock in short-term relative value trading opportunities. The Total Absolute Return strategy will normally be long spread duration, and will utilize U.S. Treasury futures to hedge rate risk and cash to hedge spread risk.

OVERVIEW

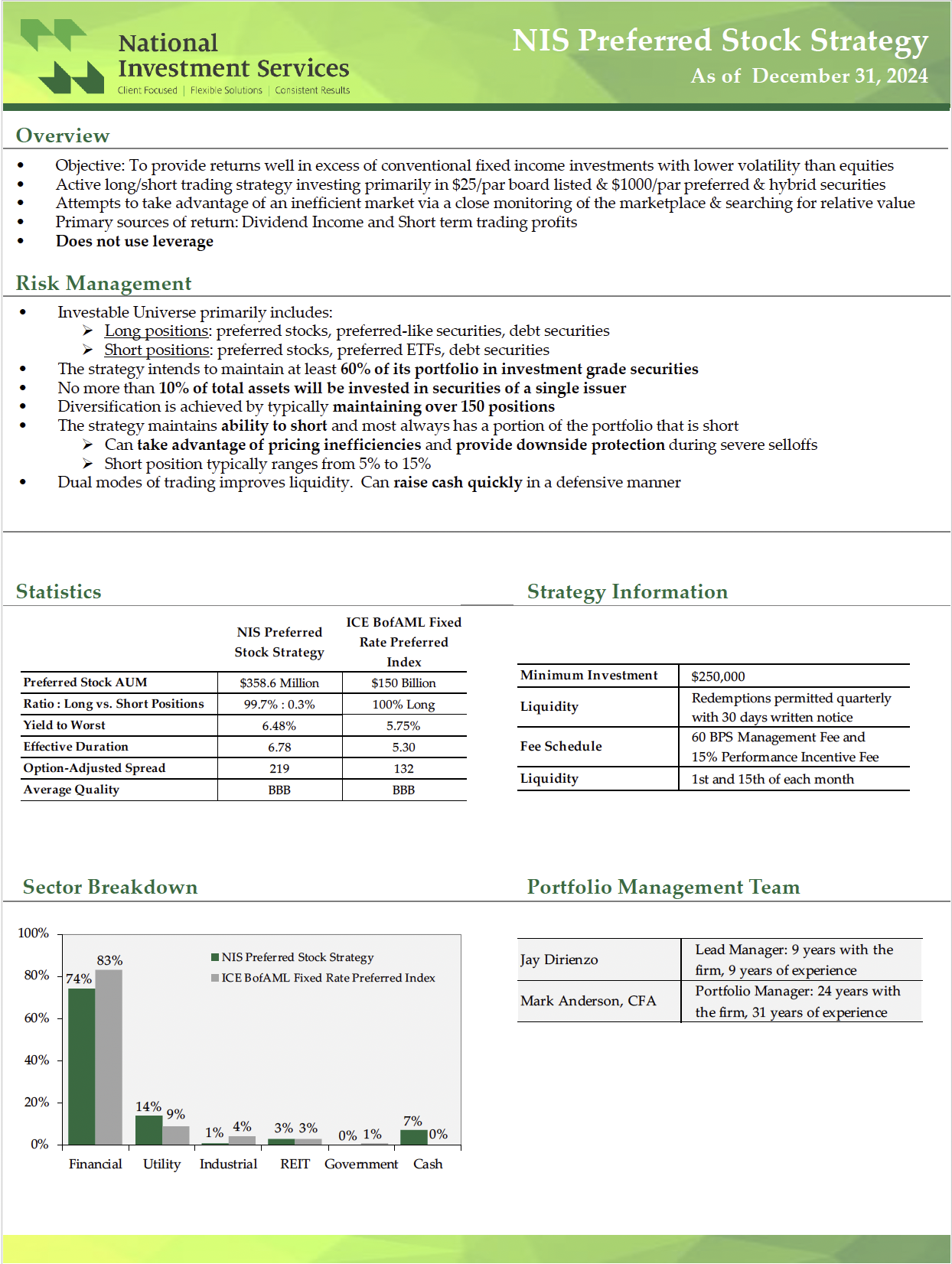

Preferred Stock

OBJECTIVE

The objective of the NIS preferred stock strategy is to provide returns well in excess of conventional fixed income investments — yet more stable returns than the equity market.

The $25 par preferred market is driven primarily by the retail investor, rather than large institutional investors. As a result, the market dynamics of preferred stocks are determined primarily by retail supply/demand characteristics rather than the factors that drive the institutional markets. The retail dynamics lend to a less efficient market. Trades tend to be relatively small in size, and while valuations typically follow the general trends of the broader markets, they tend to move on a lagged basis.

STRATEGY

- Employs an active long/short trading strategy investing primarily in $25/par board listed and $1000/par preferred and hybrid securities.

- Takes advantage of an inefficient market. We aim to take advantage of an inefficient market by closely monitoring the marketplace and searching for relative value.

- Enhanced liquidity. Most securities are traded on major public exchanges (95% NYSE), as well as over the counter by a number of dealers. This provides various avenues for trading and enhances the liquidity of the securities.

- Does not use leverage.

OVERVIEW

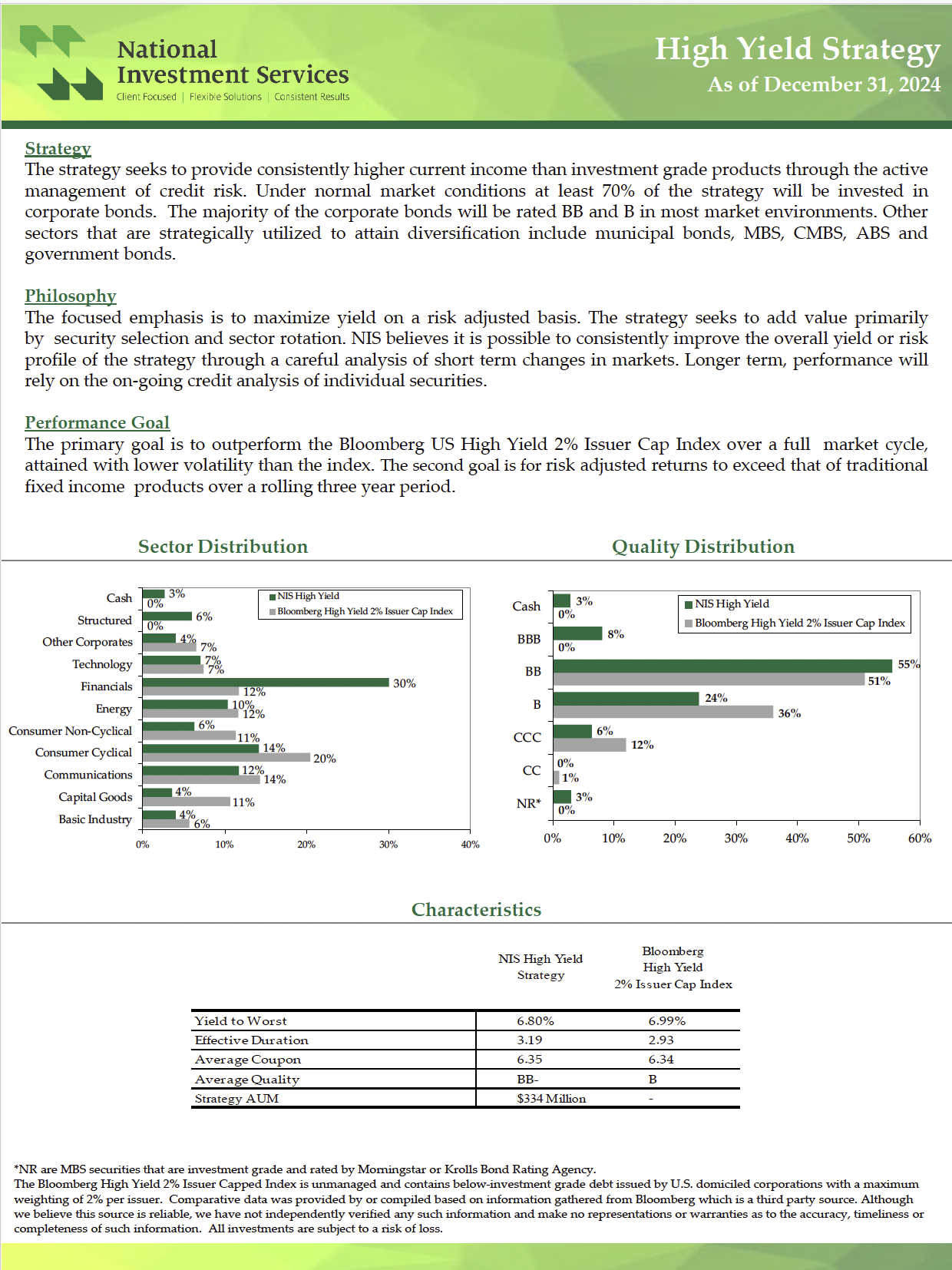

High Yield

OBJECTIVE

Our approach to high yield centers on our ability to maintain a conservative and diversified portfolio for our clients. Our high yield strategy seeks to achieve high and consistent returns with less volatility than the typical corporate high yield portfolio. Our performance objective is to outperform the Bloomberg US High Yield 2% Issuer Capped Index over a full market cycle.

STRATEGY AT A GLANCE

We seek total rate of return through the active management of credit risk. Other factors that will affect performance include analysis of industries, call risk and structure risk. Under normal market conditions at least 70% of the fund will be invested in corporate bonds. The majority of the corporate bonds will be rated BB and B in most market environments. Other sectors that are strategically utilized to attain diversification include MBS, ABS, municipal bonds and bank loans.

OVERVIEW

Short Duration High Yield Fixed Income

OBJECTIVE

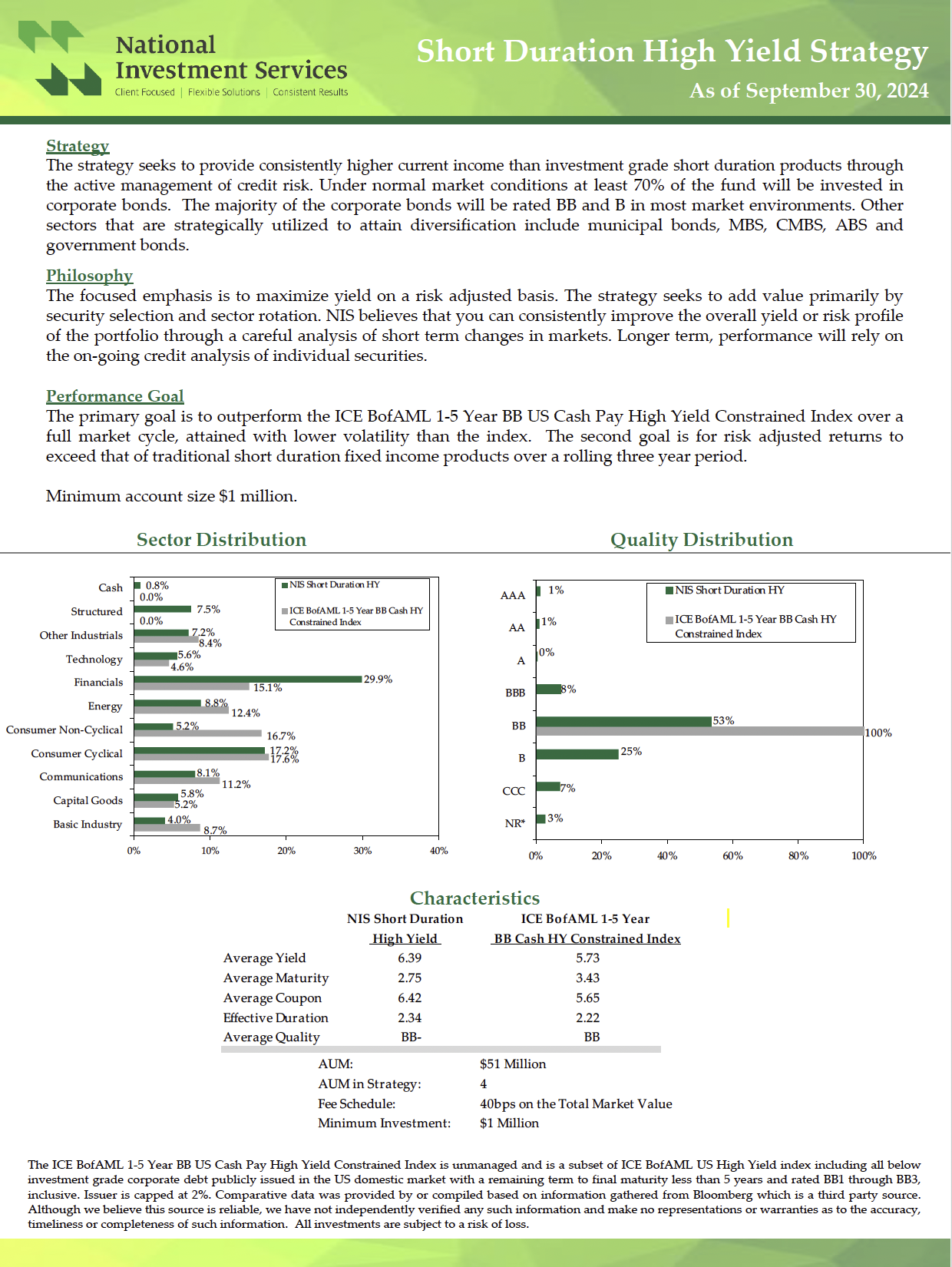

To provide consistently higher current income than investment grade short duration products. Risk adjusted returns will exceed that of traditional short duration products over a rolling 3 year period. Our primary goal is to outperform the ICE BofAML 1-5 Year BB US Cash Pay High Yield Constrained Index, attained with lower volatility than the index.

STRATEGY AT A GLANCE

We seek total rate of return through the active management of credit risk. Other factors that will affect performance include analysis of industries, call risk and structure risk. Under normal market conditions at least 70% of the fund will be invested in corporate bonds. The majority of the corporate bonds will be rated BB and B in most market environments. Other sectors that are strategically utilized to attain diversification include municipal bonds, MBS, CMBS, ABS and government bonds.