Q4 2024 Investment Review

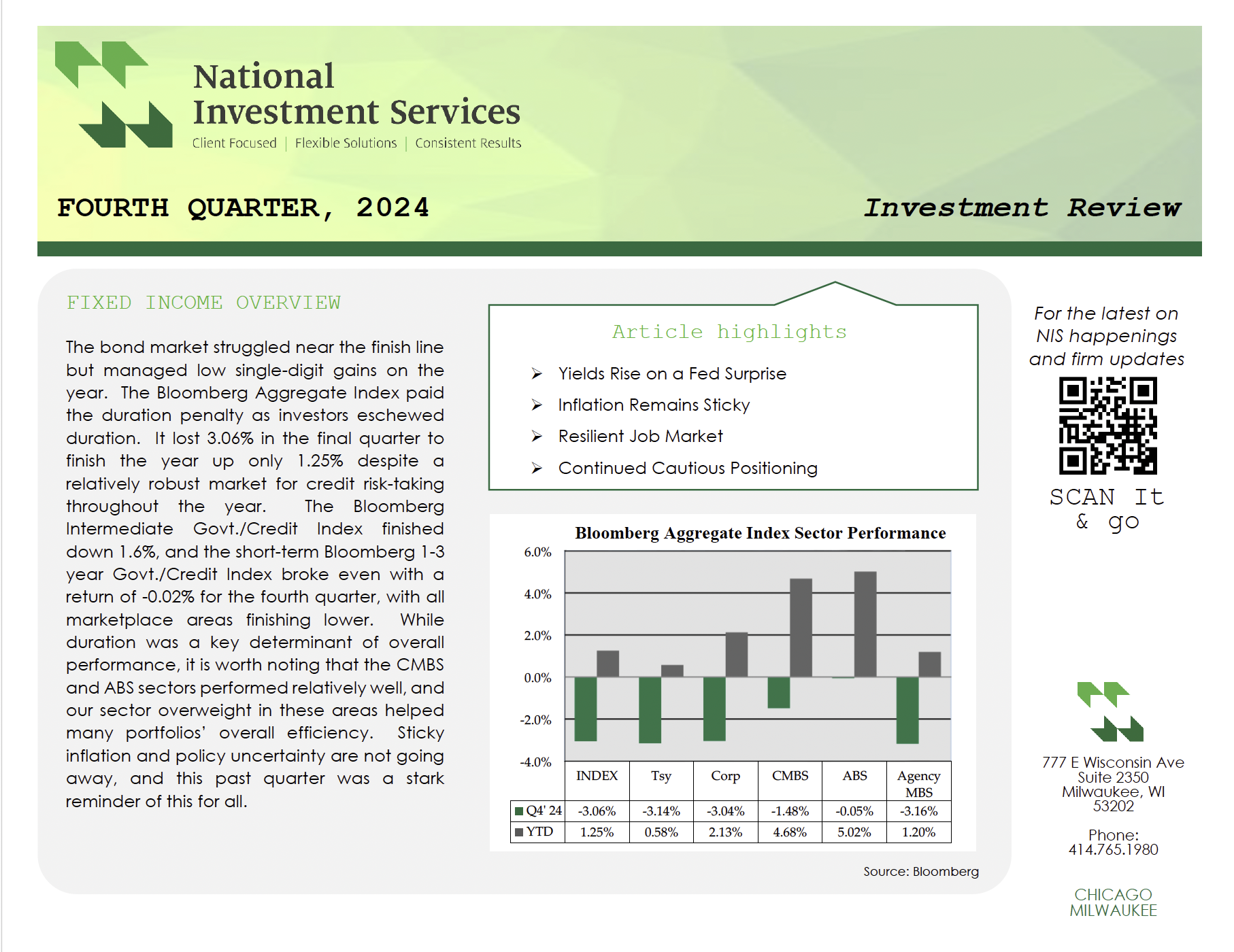

The Fourth Quarter 2024 Investment Review highlights the bond market's low single-digit gains despite a challenging final quarter. The Bloomberg Aggregate Index lost 3.06% in Q4, ending the year up 1.25%. Duration impacted performance, but CMBS and ABS sectors performed well. Persistent inflation and policy uncertainty were key challenges.

Bond yields rose after the Fed cut rates, with 2-year yields up 60bps to 4.25% and 10-year yields up 79bps to 4.57%. Corporate bond spreads rebounded, supported by high corporate margins and strong demand. The labor market moderated, adding around 200k jobs monthly, while consumer optimism remained high, reflected in retail sales growth.

For Q1 2025, NIS remains cautious on spread levels but sees opportunities in longer-duration corporate credit due to steepening yield curves and higher Treasury yields. The ABS sector remains positive, with strong demand for new issues. NIS prefers experienced, liquid issuers and finds structured products relatively cheap.