Q3 2024 Investment Review

Bond bulls got a long-awaited rally as the market embraced a slowing inflationary backdrop and a softening labor market. Market participants forecasted and received a 50 basis point cut to the Fed Funds Rate while the overall appetite for risk-taking remained solid.

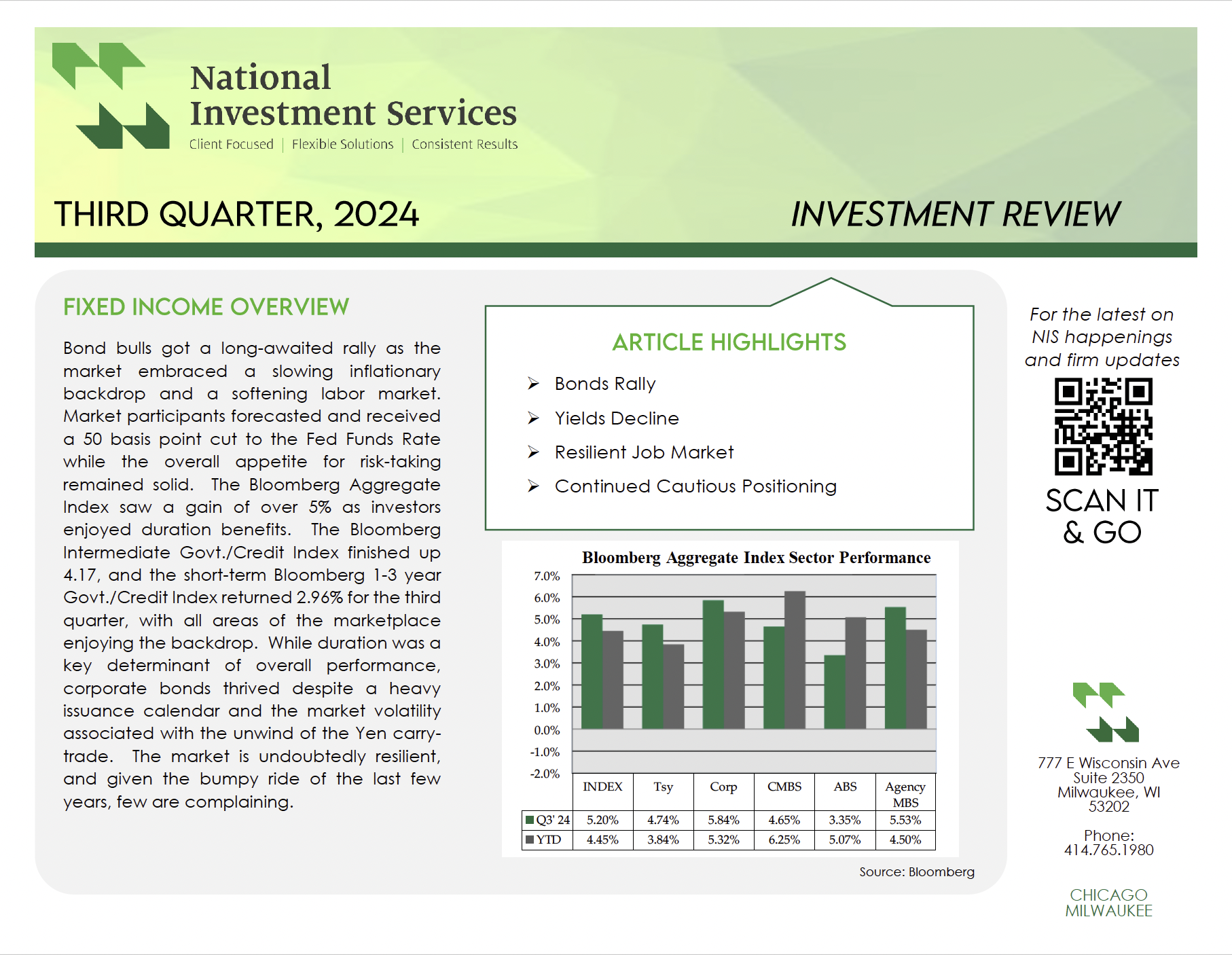

The Bloomberg Aggregate Index saw a gain of over 5% as investors enjoyed duration benefits.

The Bloomberg Intermediate Govt./Credit Index finished up 4.17, and the short-term Bloomberg 1-3 year Govt./Credit Index returned 2.96% for the third quarter, with all areas of the marketplace enjoying the backdrop. While duration was a key determinant of overall performance, corporate bonds thrived despite a heavy issuance calendar and the market volatility associated with the unwind of the Yen carry-trade.

The market is undoubtedly resilient, and given the bumpy ride of the last few years, few are complaining.