Q4 2021 Fixed Income Review

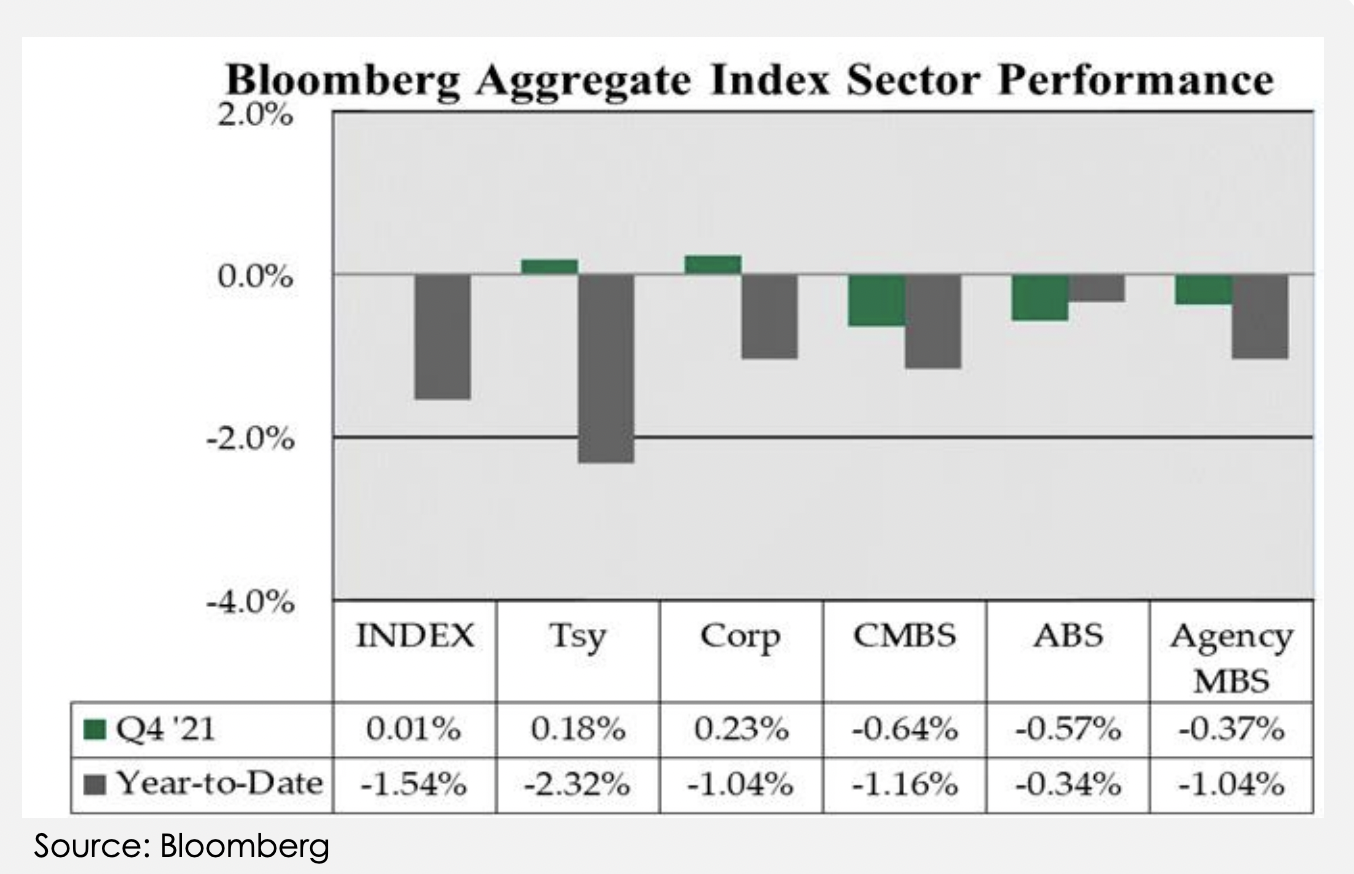

Once again, the overall fixed income market as measured by the Bloomberg Aggregate Index was essentially flat during the quarter at 0.01% vs. the third quarter at 0.05%.

Just as the market was digesting the uptick in Delta variant cases, as well as a Federal Reserve that was sounding a bit hawkish, another letter of the Greek alphabet, Omicron, became a part of our collective vocabulary. Uncertainty surrounding its quick spread and the possibility of its severity gave investors pause just in time for the holidays.

The table to the right shows that U.S. Treasuries and corporate bonds were up slightly on the quarter, while segments of the structured sector finished lower. This general weakness was reflected through the year as the index finished down about 1.5% for the year as inflation and rising yields pressured values.

Meanwhile, rising yields on the short-end and in the belly of the Treasury curve pushed the Bloomberg Intermediate Govt. /Credit Index 57bps lower on the quarter, while the short duration Bloomberg 1-3yr. Govt./Credit Index finished -0.56%.

Download the Full Quarterly Review